If you work for a hospital or health system, you’ve likely heard the term healthcare revenue cycle used around your place of employment. But what exactly is this process? And why do hospitals need to track all administrative and clinical data?

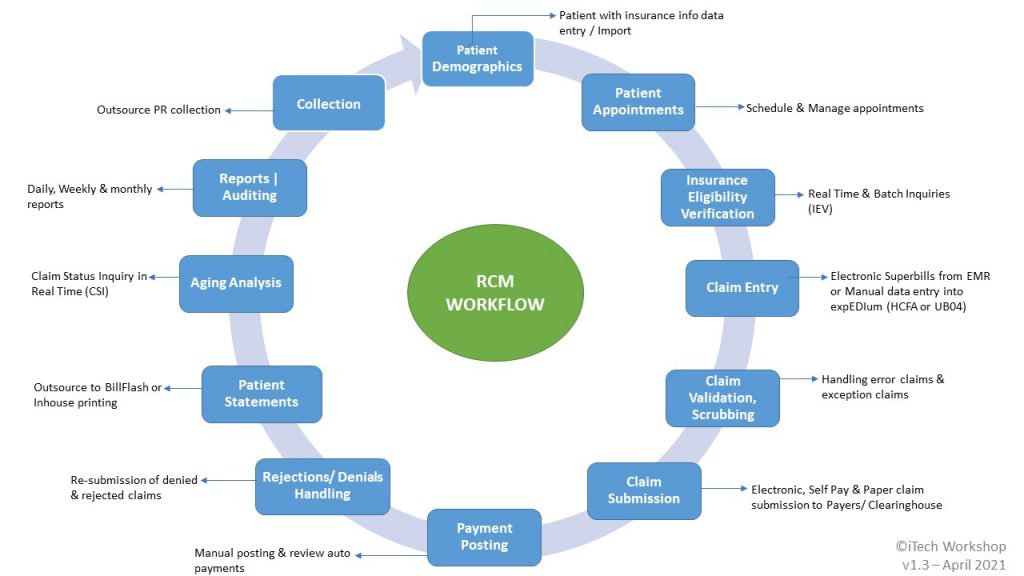

In an era of increased complexity within the healthcare industry, it is vital to have a better understanding of the healthcare revenue cycle management (RCM) process. For professionals involved in the healthcare sector, understanding the steps of this process is critical for success. In this blog, let us explore the 12 steps of healthcare revenue cycle management that iTech follows and explain each step’s importance.

- Patient Demographics

This step benefits both the clinic and the patient equally. Besides not having to wait in a waiting room for an extended period, patients can also find out their out-of-pocket costs ahead of time, so they are not surprised by their bills. For hospitals, there is a greater chance that patients will pay their bills on time, eliminating negative debt sources.

The pre-registration section usually includes the patient’s name, demographics, medical history, insurance information, and payment options. By streamlining the process, patient satisfaction can be guaranteed.

- Patient Appointments

It is common for hospitals and clinics to use billing/EMR software that provides scheduling and appointment management features. In the case of frequent patient visits, clinics may already have the patient’s data stored in their secure database. All they have to do is verify that the insurance details are still valid. However, front-office staff can validate a new patient registering through the portal by pulling up all the information they need.

- Insurance Eligibility Verification

Omitting this step or making errors during this step can cause monetary loss to the management. Therefore, the front-office staff must be equipped to handle this task efficiently. If they are using software, they must also be proficient in using it to their advantage. Our expEDIum PMS has seamless Eligibility Features that can verify the insurance details in real-time or batch and connect to hundreds of payers, including MEDICARE & MEDICAID.

- Claim Entry

This step is usually completed within 24 to 48 hours of receiving the claim or charge in the respective system. After the claims are captured on the bill from the service/encounter, they are submitted to the insurance company seamlessly through a clearing house.

- Claims Validation & Scrubbing

Prior to submitting the claim, it is important to prepare it and determine if any modifications need to be made. It is possible for claims to fail due to one or more data errors or due to failure of standard rules/edits. Therefore, you should handle all exceptions in the claims and work closely with the billing staff to get the data you need. It could also help keep first-time payers’ acceptance rate close to the high 90th percentile.

- Claim Submission

As soon as hospitals have coded health services into management systems, they must submit claims to insurance companies to process payments according to the contract. A claim that isn’t sent to the insurance company (which can occur for several reasons) can cause a delay in hospitals receiving their reimbursements from the insurance companies. In addition to detecting any pending secondary claims, expEDIum can submit the claims to the Carrier/Payers on the same day or within 48 hours.

- Payment Posting

A payment posting process, also known as cash posting, allows for the viewing of payments and provides a snapshot of how the financial picture is looking by identifying the problems and resolving them as soon as possible. Depending on the result of the adjudication of the payer’s claim, the claim will either be paid or denied, and an EOB (Explanation of Benefits) will be sent to the healthcare provider. In this step, the healthcare service provider is able to track incoming payments.

- Claims Rejections and Denials

Be aware of the difference between a rejected and a denied claim. Generally, a rejected claim means you did not provide the necessary information to determine coverage, like a billing error. In contrast, a denied claim means you do not meet the eligibility criteria.

In spite of changes in payment methodologies, healthcare providers in the United States suffer significant revenue loss due to claim denials. As reported by the Healthcare Financial Management Association™, out of $3 trillion of claims submitted by healthcare organizations, $262 billion were denied. This translates to an average of $5 million in denials per provider.

- Patient Statements

Patients can receive patient statements by regular mail or electronically and securely. It is likely that you spend a lot of money on sending out patient statements as a healthcare provider. The sole purpose of your administrative staff might be to manage medical billing. At iTech, we have partnered with BillFlash® for the creation of patient statements.

- Aging Analysis

To assess an organization’s revenue cycle, medical practices need to review their monthly revenue reports. Depending on how tight the cash flow is managed at a hospital/clinic, the staff may use 15 days or 30 days aging criteria to determine whether the cash flow is being managed efficiently and what percentage of claims are unpaid after the threshold period.

According to the aging report, the invoice totals for each customer are calculated based on the invoice age. For example, when a customer has several bills acquired at different times, an aging report will indicate when each of them is due. In addition, they can reveal the number of patients and insurance payers who are late with their payments. In reviewing expEDIum’s seamless online CSI feature, you can see how it can avoid A/R calls in this regard.

- Reports & Auditing

Your revenue cycle also includes financial reporting. Your practice may have various financial reporting requirements, from taxes to audits to financial statements. RCM software can help ensure you have accurate, up-to-date data to complete these year-end reports and requirements.

- Patient Collection

Monitoring outstanding accounts and pursuing payment from patients is part of this process. Patient collections are becoming more crucial to revenue as patient financial responsibility continues to increase due to high-deductible health plans. Additionally, hospitals need to be careful about how they present their pricing because if patients receive a higher-than-expected bill, it can take longer for them to get paid, resulting in more bad debt.

While factoring the stats, with over 7,300 users and 2,300 providers, expEDIum billing solution and claims portal have processed more than 1.7 million claims, 7.2 million plus HIPAA transactions, and more than $320 million in total claim charges over the last year.

In this regard, as the healthcare revenue cycle continues to evolve, it is more important than ever for hospitals and healthcare organizations to maintain a high level of patient-centric care. By working together as one unit and maintaining accurate contract data, the hospital/clinic will be able to provide an optimal patient experience while maintaining an excellent reputation.