You’ve delivered quality care, billed correctly, and submitted claims on time. But if payments still aren’t arriving when they should, your practice has a collections problem. It’s one of the most overlooked challenges in healthcare revenue management.

Collections are the bridge between services rendered and money in the bank. When that bridge is weak, practices struggle with unpredictable cash flow, delayed investments, and mounting frustration.

The Real Cost of Delayed Collections

Late or missed payments aren’t rare—they’re common. A survey found that 15% of healthcare providers lose more than 10% of their revenue due to late payments. That’s not a small number—it’s enough to impact payroll, hiring, or technology upgrades.

On top of that, studies show that practices using manual billing methods see higher write-offs, while those with automated AR management report 10–15% fewer bad-debt write-offs and up to 22% reduction in Days Sales Outstanding (DSO). The message is clear: weak collections don’t just delay revenue—they erase it.

Why Collections Break Down

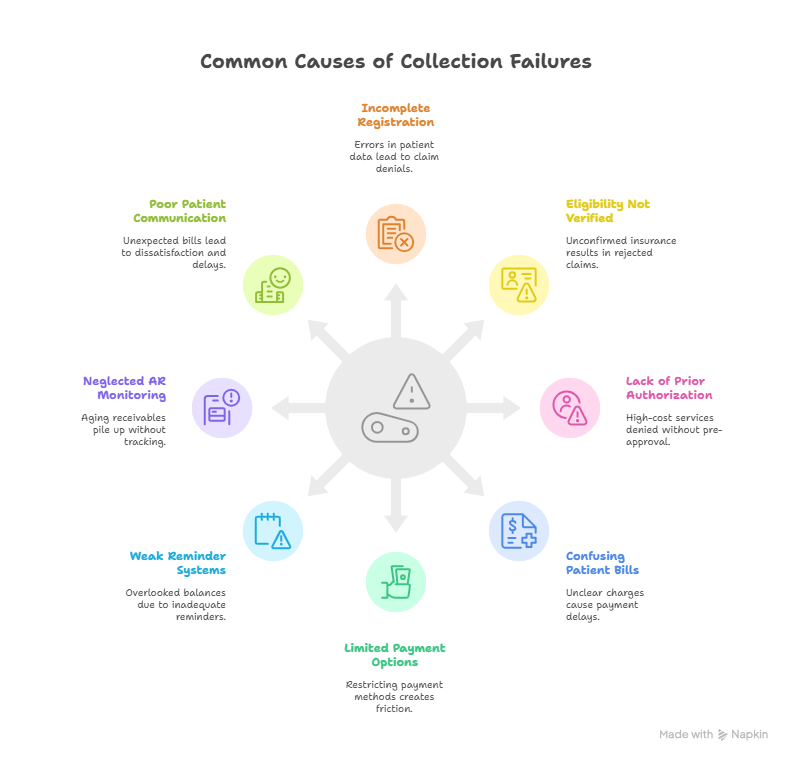

Collections often fail not because patients don’t want to pay, but because of avoidable process gaps within the practice. Some of the most common causes include:

- Incomplete Patient Registration: Errors such as incorrect date of birth, insurance ID, or address can lead to claim denials and delays in billing.

- Eligibility Not Verified: When insurance coverage isn’t confirmed upfront, claims may later be denied due to inactive or lapsed policies.

- Lack of Prior Authorization: High-cost services without proper pre-approval are at risk of being rejected by payers, leaving balances unresolved.

- Confusing Patient Bills: Patients who don’t clearly understand their charges are less likely to make timely payments.

- Limited Payment Options: Restricting payments to only checks or cash creates friction for patients who prefer digital or mobile payment methods.

- Weak Reminder Systems: Relying solely on paper statements or a single reminder often results in unpaid balances being overlooked.

- Neglected AR Monitoring: Without dashboards or systematic tracking, aging receivables quickly pile up and become difficult to collect.

- Poor Patient Communication: When patients aren’t informed about costs upfront, they may feel blindsided by unexpected bills, leading to dissatisfaction and delayed payments

Building Stronger Collections Workflows

Improving collections requires both patient-friendly processes and internal accountability. A structured approach makes it manageable:

| Step | Challenge It Solves | Measurable Impact |

| Estimate Costs Upfront | Patients uncertain about out-of-pocket charges | Fewer disputes and faster payments |

| Offer Digital & Flexible Payment Options | Limited access methods | Earlier collections, higher patient satisfaction |

| Automate Reminders | Bills forgotten or misplaced | Reduced overdue AR, fewer write-offs |

| Use AR Dashboards | Lack of visibility into overdue accounts | Proactive follow-up, reduced DSO |

| Review Aging Receivables Weekly | Long-overdue accounts piling up | Higher recovery before debts become uncollectible |

These aren’t one-time fixes but habits that strengthen collections over time.

Collections as a Growth Lever

Strong collections don’t just improve cash flow; they unlock growth. With predictable revenue, practices can:

- Expand services or open new locations.

- Invest in technology and staff training.

- Negotiate better contracts with vendors or payers.

Simply put, smoother collections create breathing room for innovation.

If your practice is struggling with overdue payments, start small. Run a 90-day AR aging report and identify the accounts holding the most revenue. Once you know where the bottleneck is—unclear billing, slow reminders, or limited payment methods—you can act decisively.

How expEDIum Helps

expEDIum works with practices to strengthen collections workflows by simplifying patient billing, integrating digital payment channels, and automating reminders. Our focus is to help practices improve cash flow without burdening staff with extra tasks.

If you’d like to see how your collections process measures up, reach out for a quick consultation. Together, we can identify where your practice is losing revenue and how to recover it faster.

Suvarnna Babu is a B2B content marketer and Digital Marketer at expEDIum, where she specializes in writing healthcare tech blogs that simplify complex RCM and EHR concepts for providers and billing professionals. With a background in English Literature and hands-on experience in SEO, email marketing, and paid ads, she creates content strategies that align with business goals and resonate with real-world users.